Passive investments

Don’t try to beat the market, buy the market.

We’ve learned that investing in asset classes, like “stocks”, is better than investing in individual assets, like “General Motors”. In this section, we’re going to explore exactly how to invest in asset classes.

Active management is a losing strategy

For many, the idea of “stock market investing” means identifying the stocks of undervalued companies, and buying them at low prices in order to sell them later at higher prices. In fact, an entire industry of active management investment companies are waiting to do just this for you!

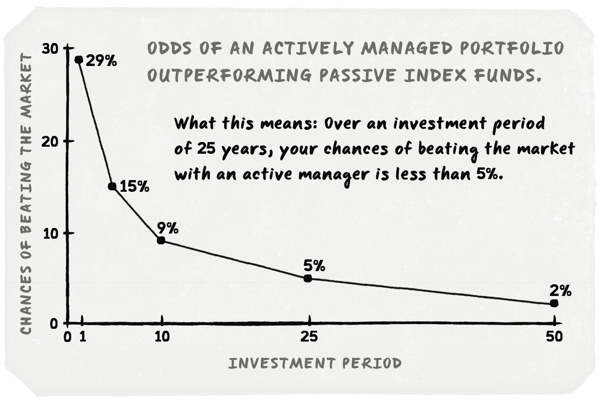

But studies have overwhelmingly demonstrated that—in the long term—almost nobody can beat the market itself by picking and choosing individual stocks. If, over a period of 10 years, the stock market as a whole increased 8% per year, more than 95% of all active managers will return less than 8%, once their fees are accounted for.

This is super important, for two reasons.

-

As a consequence, you should buy entire markets rather than individual companies or assets.

-

As you get deeper into investing, you will find yourself pitched by active managers, and will tempted by their short-term returns. Ignore them, and never forget the first point—that we need to be investing in entire markets.

Introduction to “indexes”

So how can we invest in an entire market? It’s actually very easy!

A number of organizations publish what are known as “indexes”—which are lists of companies or assets that represent entire markets or asset classes.

For example, the “MSCI US Broad Market Index” lists over 3,000 companies that represent the stock market of the United States. The “MSCI ACWI ex-USA IMI Index” lists over 6,000 companies that represent most investible stock markets outside the United States.

Indexes exist for just about every asset class in which we might want to invest—from stocks, to bonds, to commodities, cryptocurrencies, and even Chinese real estate.

How do we buy an entire market?

It turns out that many financial companies offer investment products which track these indexes. For example, rather than purchase a single share of Apple stock, we can purchase a single share of the “Vanguard Total Stock Market ETF”—and with that one purchase, we’ll be buying a fractional share of over 3,000 companies found in the product’s underlying index.

That’s worth repeating—with a single purchase, we can buy the entire American stock market.

Index-tracking products are referred to as passive investments, in that they just buy the stocks of companies that belong to the underlying index. No decisions involved. This is in contrast to active investment products, in which a manager (human or computer) is continually picking and choosing the stocks or assets they believe will beat the overall market.

How well do active products do? The results are conclusive, and astounding.

In the long run, say over 25 years, the chances that an active investment manager can beat the stock market are less than 5%, as illustrated in this data borrowed from John Bogle’s, Little Book of Common Sense Investing. In summary, these data show that your chances of picking an active manager who can beat the market over 25 years is less than 5%.