Investment period

Patience is more than a virtue—it’s money.

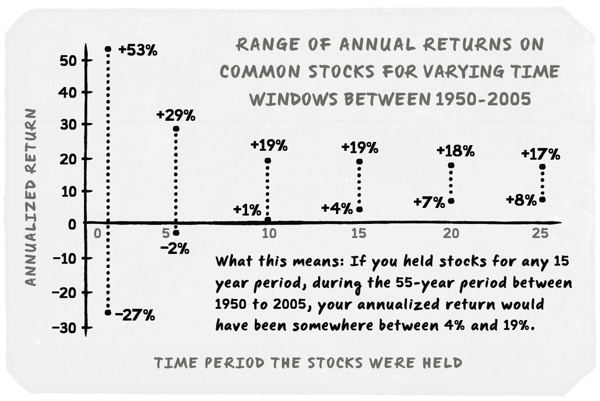

Holding volatile investments, like stocks, over a long period of time reduces the risk of losing money. Let’s look at a graph of what happens when we hold stocks for different periods of time.

What does this chart tell us?

-

During the 55-year period between 1950 and 2005, if we had held stocks for any particular one-year period, we could have gained as much as 50%, or we could have lost nearly 30%. Ouch—holding stocks for just one year seems risky!

-

When held for any 5-year period during those 55 years, the annualized return would have been somewhere between about +29% and −2%. That sounds a little better.

-

Looking further, we see that stocks held for any 10-year period during those 55 years would have never lost money.

-

But held for any 20-year period during those 55 years, the minimum annualized return we would have earned would be 7%, and the maximum, 18%. Now we’re talking!