Compounding returns

The powerful force that allows even those with modest incomes to accumulate large savings.

Compounding returns is simply earning money on past earnings, and is the most important concept in this book. It’s what turns small saving, into large amounts of money.

Let’s walk through an example:

-

Say you have $100 in savings, earning 4% per year. After the first year, you’ll have $104—i.e. your original $100, plus $4 of earnings. Makes sense, right?

-

After the second year you’ll have $108.16—i.e. another $4 earned on your original $100 savings, plus $0.16 earned on last year’s earnings of $4.

-

After the third year, $112.49—i.e. another $4 on your original $100, plus $0.33 on your last two years earnings of $8.16.

Earnings on earnings, year after year. Compound returns.

It’s hard to believe such a simple concept could be so important. But after many years of investing, the majority of your savings will have come from compound returns, rather than original investments.

Consider this example:

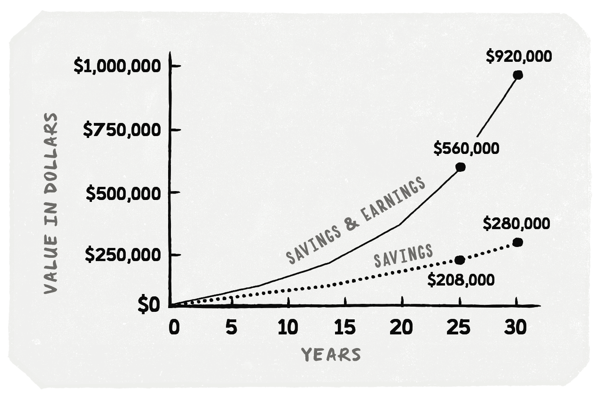

Stephanie is 25, and has a salary of $50,000. Her pay increases yearly with inflation. If she saves just 10% of her income, and earns an 8% annual return, then at age 55 she will have invested $280,000, but will have accumulated nearly one million dollars!

It’s super important to understand the concepts in this chart:

-

The power of compounding returns — After 30 years, far more of her final balance of $920,000 comes from earnings ($640,000), than from the money she actually saved ($280,000). Earnings on earnings. Compound returns.

-

The importance of time — The power of compounding returns comes late in the game. Waiting just five years to start, would have reduced her final balance by 40% ($565,000 compared to $920,000).

-

The importance of the annual rate of return — What if Stephanie had just put her money in the bank, earning 3% per year? Her final balance would be $420,000—i.e. decreasing her annual return from 8% to 3% decreases her final balance by more than half!