Predicting the price of oil

In Money for Something, we talk about the importance of investing in a diversified portfolio of passive assets that track entire markets because of the overwhelming data that demonstrates that nobody can predict the market. Along those lines, I wanted to give an example from recent history.

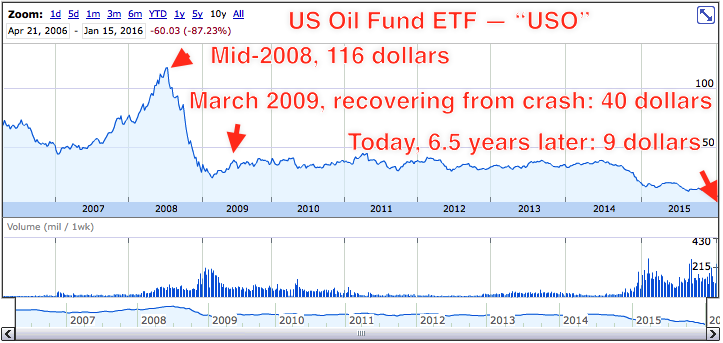

Between June and December of 2008, the price of oil plummeted in a crash. The price of the United States Oil Fund, an ETF, went from $116 per share to around $30.

By March of 2009, the ETF price had recovered to $40, people like Jim Rogers were writing about the coming oil scarcity crisis, and the world was talking as if buying oil was the opportunity of a lifetime.

A friend who was bullish on oil commented, “Is there any scenario in which you could conceivably imagine that in five years from now, a barrel of oil is less than $150?”

Let’s take a look at what did happen over the next six and a half years for those investors:

Had you bought USO in March of 2009, you’d be down today by 77%.

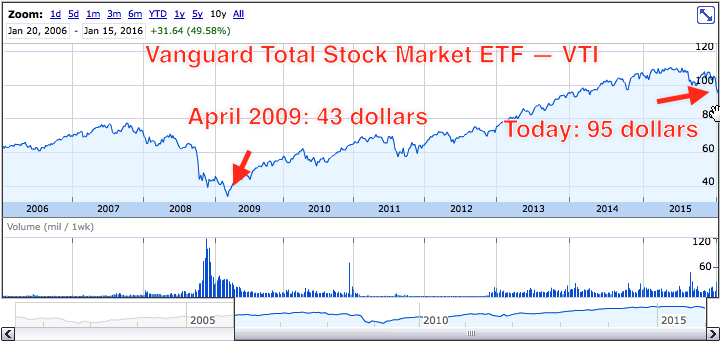

Let’s see what would have happened if you’d given up on trying to predict things, and just bought the whole stock market. Here’s the chart of the Vanguard Total Stock Market ETF, VTI. Buying a share of VTI is the same as buying a tiny share of nearly every public company in the United States.

Had you bought the entire US stock market in April of 2009, you’d be up today by 120%.

Keep this in mind next time somebody tells you about a sure bet.